Review: Quicken Premier 1-Year Subscription for Online

An All-In-One Financial Management Solution

Are you looking for a comprehensive and efficient financial management solution? Look no further than Quicken Premier. With its powerful features and user-friendly interface, Quicken Premier is designed to help you take control of your finances. Whether you are an individual or a small business owner, this software is the perfect tool to manage your accounts, investments, and budget effectively.

The Benefits of Quicken Premier

As a Quicken Premier subscriber, you gain access to a wide range of features that are tailored to meet your specific needs. Let’s take a look at some of the key benefits of using this software:

1. Comprehensive Account Management

Quicken Premier allows you to link all your financial accounts in one place, so you can easily track your income and expenses. From checking and savings accounts to credit cards and loans, you can view all your transactions and balances with just a few clicks.

2. Powerful Investment Tracking

If you have investments, Quicken Premier offers robust tools to help you manage them effectively. You can track the performance of your stocks, bonds, and mutual funds, as well as monitor your portfolio’s diversification. With real-time updates and historical data, you can make informed investment decisions.

3. Budgeting Made Easy

Gone are the days of manually tracking your spending and creating excel sheets for budgeting. Quicken Premier makes budgeting a breeze by automatically categorizing your transactions and giving you insights into where your money is going. You can set financial goals, track your progress, and receive alerts when you exceed your budget.

4. Bill Management

Keeping track of bills and due dates can be overwhelming. Quicken Premier simplifies the process by allowing you to link your bills and pay them directly from the software. You can also set up reminders and receive alerts, so you never miss a payment again. Say goodbye to late fees!

5. Tax Planning

With tax season just around the corner, Quicken Premier helps you stay organized and prepared. It categorizes your expenses and generates reports that can be exported to tax software, making the tax filing process seamless. You can also keep track of tax-deductible expenses and maximize your deductions.

Is Quicken Premier Worth the Investment?

Now that we’ve explored the features and benefits of Quicken Premier, let’s discuss whether it’s worth the investment. Priced at $79.99 for a 1-year subscription, Quicken Premier might seem like a significant upfront cost, but the value it provides makes it worth every penny.

1. Time-Saving

Quicken Premier saves you a considerable amount of time by automating tasks that would otherwise be done manually. From importing transactions to categorizing expenses, the software streamlines your financial management process, allowing you to focus on more important things.

2. Financial Insights

With Quicken Premier, you gain valuable insights into your financial situation. By seeing the big picture, you can identify areas where you can save money, invest more wisely, and ultimately achieve your financial goals. This level of visibility is invaluable in making informed financial decisions.

3. Peace of Mind

Quicken Premier provides peace of mind by keeping your financial information secure. The software uses robust encryption technology to protect your data from unauthorized access. You can also set up password protection and enable two-factor authentication for an extra layer of security.

4. Customer Support

If you run into any issues or have questions about using Quicken Premier, their customer support team is readily available to assist you. Whether you prefer phone support, email, or live chat, you can expect prompt and helpful responses from their knowledgeable staff.

Making the Most of Quicken Premier

To maximize the benefits of using Quicken Premier, here are a few tips:

1. Sync Your Accounts

Make sure to sync all your financial accounts with Quicken Premier to have an accurate and up-to-date view of your finances. This includes your bank accounts, credit cards, loans, investments, and retirement accounts.

2. Customize Categories

Take the time to personalize the categories in Quicken Premier to match your spending habits. This will make budgeting and expense tracking even more accurate and meaningful.

3. Regularly Review Reports

Quicken Premier offers a variety of reports that can give you deeper insights into your finances. Take advantage of these reports and review them regularly to identify trends, make adjustments, and monitor your progress towards your financial goals.

4. Utilize Sync Mobile App

Quicken Premier comes with a mobile app that allows you to track your finances on the go. Make sure to download and sync the app with your desktop software to have access to your financial information anytime, anywhere.

The Verdict

Quicken Premier is a powerhouse when it comes to financial management software. Its comprehensive features, user-friendly interface, and robust support make it an excellent choice for individuals and small businesses alike. With Quicken Premier, you can take control of your finances, make informed decisions, and achieve your financial goals. Invest in Quicken Premier today and experience the difference it can make in managing your money.

![Amazon.com: Band-in-a-Box 2019 Pro for Mac [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2024/04/2O6e4Cw25Z6a.jpg) Band in a Box 2019 Flash Drive Review

Band in a Box 2019 Flash Drive Review  WorldViz SightLab Tracking Software Omnicept Review

WorldViz SightLab Tracking Software Omnicept Review  Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8

Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8  Review of Image Line Software Studio Signature Bundle

Review of Image Line Software Studio Signature Bundle  FileMaker Pro Advanced Review

FileMaker Pro Advanced Review ![Amazon.com: Punch! ViaCAD 2D/3D v12- For Mac [Mac Download] : Software](https://www.coupondealsone.com/wp-content/uploads/2024/04/YBusi9QdX6E2.jpg) ViaCAD v12 for Mac Review

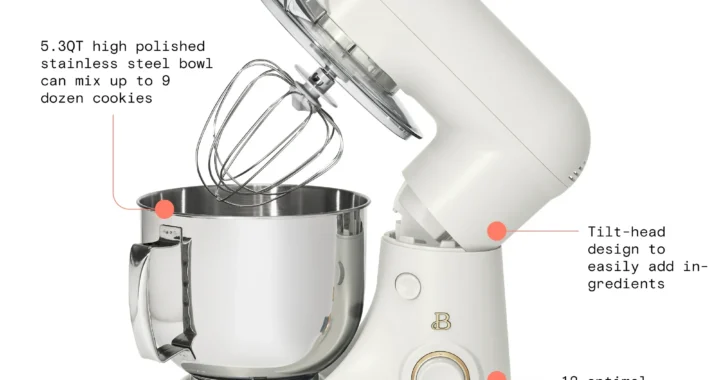

ViaCAD v12 for Mac Review  Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer

Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer  Review of the Sterilizer Charging Wireless Certified Sanitizer

Review of the Sterilizer Charging Wireless Certified Sanitizer  DESTEK VR Controller Review

DESTEK VR Controller Review