Home Budget Planner: The Ultimate Financial Solution

![Amazon.com: Home Budget Planner 1.0 for Windows [Download] : Software](https://www.coupondealsone.com/wp-content/uploads/2023/04/jdiujxESxUvs.jpg)

Managing finances can be a daunting task for anyone, but it’s especially challenging if you don’t have a clear idea of where your money is going. That’s where the Home Budget Planner comes in – this powerful financial tool is designed to help you take control of your money and achieve your financial goals.

What is the Home Budget Planner?

The Home Budget Planner is a comprehensive financial management tool designed for households and small businesses. It allows you to track your income and expenses, create and manage budgets, and generate detailed reports and charts. With its user-friendly interface, you don’t have to be a financial expert to start budgeting like a pro.

Why use the Home Budget Planner?

There are many reasons why you should consider using the Home Budget Planner to manage your finances:

1. It helps you save money

One of the main benefits of the Home Budget Planner is that it helps you identify areas where you might be overspending. With its detailed reporting features, you can quickly see how much money you’re spending on different categories like groceries, entertainment, and utilities. This can help you make informed decisions about how to cut back and save money.

2. It’s easy to use

The Home Budget Planner is designed to be user-friendly, even if you don’t have any experience with financial management tools. It has a simple interface that allows you to easily enter your income and expenses and create budgets. Plus, its reporting features are easy to understand and can provide valuable insights into your spending habits.

3. It helps you achieve your financial goals

Whether you want to save for a vacation or pay off debt, the Home Budget Planner can help you reach your financial goals. By creating and monitoring a budget, you can see exactly how much money you need to set aside each month to achieve your goals. And as you track your progress, you’ll be motivated to keep going.

Features of the Home Budget Planner

The Home Budget Planner is packed with features that make it the ultimate financial management tool:

1. Income and expense tracking

You can easily track your income and expenses with the Home Budget Planner. You can input all your financial transactions from your bank account, credit card or cash payments so that you can track how much money you have and how much you have spent. This helps you make informed decisions and adjust your spending habits accordingly.

2. Budget creation and management

The Home Budget Planner allows you to create and manage budgets for various categories like food, rent, utilities, entertainment and many more. You can allot different budgets to different categories, and the program will remind you if you’re getting close to exceeding your budget limit. By having a clear idea of how much money you have to spend in each category, you can avoid overspending and stay on track.

3. Customizable reports and charts

With the Home Budget Planner, you can generate detailed reports and charts that provide valuable insights into your spending habits. You can customize these reports in various ways, and with the charts, you can quickly see how much of your income is going towards different categories.

4. Bill reminder

The Home Budget Planner has a bill reminder feature, where you can input all your bills and payments with the due date to make sure you don’t miss any payments.

5. Data security

The Home Budget Planner is designed with your security in mind. All your financial data is stored locally on your computer, so you don’t have to worry about your sensitive information being sent over the internet. You also have the option to password-protect your data, so only you can access it.

How to use the Home Budget Planner

Using the Home Budget Planner is easy, here are the steps for using it:

Step 1: Download and install

First, you need to download the Home Budget Planner from the official website and install it on your computer.

Step 2: Set up your accounts and budgets

Once the software is installed, you need to set up your accounts and budgets. You can add your accounts like bank accounts, credit card accounts and cash accounts. After that, you can create budgets for different categories like groceries, rent, utilities and so on.

Step 3: Input your income and expenses

You can then start inputting your income and expenses into the program. You can do it manually or import statements from your bank or credit card accounts. The software will automatically categorize your expenses into the appropriate categories.

Step 4: Generate reports and charts

Once you have entered all your financial information, you can generate reports and charts to get a better understanding of your spending habits. You can easily see where your spending is going and determine where you can make cutbacks to save money.

What users are saying about the Home Budget Planner

Many users have found the Home Budget Planner to be an invaluable tool for managing their finances:

“This program has helped me get my spending under control. It’s so easy to use and the reports are very detailed.” – Susan S.

“I’ve tried other financial programs before, but this one is by far the best. It’s packed with features and has helped me save so much money.” – John L.

“I love how easy it is to set up budgets and track my expenses. The bill reminder feature is also very helpful.” – Karen T.

Conclusion

Overall, the Home Budget Planner is an excellent financial management tool that can help you take control of your finances. With its easy-to-use interface, comprehensive features, and customizable reports, it’s the ultimate solution for managing your household or small business budgets. So why not try it out and see how much it can help you achieve your financial goals?

![Amazon.com: Band-in-a-Box 2019 Pro for Mac [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2024/04/2O6e4Cw25Z6a.jpg) Band in a Box 2019 Flash Drive Review

Band in a Box 2019 Flash Drive Review  WorldViz SightLab Tracking Software Omnicept Review

WorldViz SightLab Tracking Software Omnicept Review  Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8

Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8  Review of Image Line Software Studio Signature Bundle

Review of Image Line Software Studio Signature Bundle  FileMaker Pro Advanced Review

FileMaker Pro Advanced Review ![Amazon.com: Punch! ViaCAD 2D/3D v12- For Mac [Mac Download] : Software](https://www.coupondealsone.com/wp-content/uploads/2024/04/YBusi9QdX6E2.jpg) ViaCAD v12 for Mac Review

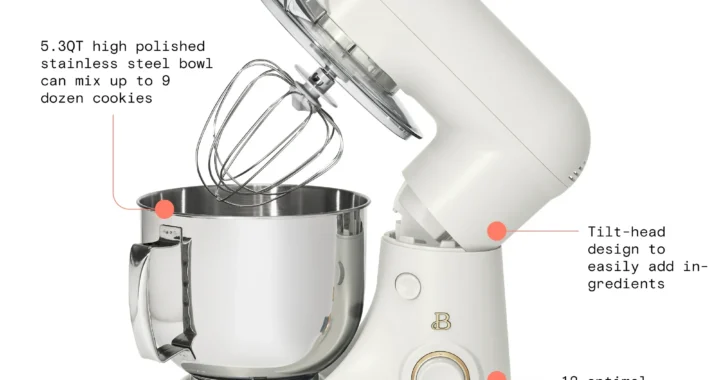

ViaCAD v12 for Mac Review  Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer

Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer  Review of the Sterilizer Charging Wireless Certified Sanitizer

Review of the Sterilizer Charging Wireless Certified Sanitizer  DESTEK VR Controller Review

DESTEK VR Controller Review