QuickBooks Enhanced Payroll 2011 Version Review

![Amazon.com: QuickBooks Enhanced Payroll 2011 - [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2023/04/2Kwcpli6SFgj.jpg)

Introduction

QuickBooks Enhanced Payroll 2011 is a software that is designed to make processing payroll easy and seamless. This version of the software has been improved and comes with an array of features that will make payroll processing and accounting a breeze for many small and medium-sized companies. It is an all-in-one tool that streamlines payroll, tracks employee time, and manages taxes.

Key Benefits

One of the key benefits of QuickBooks Enhanced Payroll 2011 is its ease of use. Even if you are not well-versed in bookkeeping and accounting, you can easily use this software to handle payroll smoothly. It is designed with a simple user interface that is intuitive and easy to navigate. With this software, you can pay employees, manage taxes, print paychecks, file forms, and run reports with just a few clicks.Another benefit of QuickBooks Enhanced Payroll 2011 is its time-saving features. The software automates many of the payroll processes that would have taken hours to complete manually. You can add employee information, set up direct deposit, and manage taxes in just a fraction of the time it would have taken using traditional payroll methods.

Features

QuickBooks Enhanced Payroll 2011 has an array of features that helps companies manage their payroll and taxes effectively. Some of its notable features include:

1. Employee Management

This feature makes it easy to manage all employee data from one place. You can add new employees, track their hours, make changes to their payroll data, and more.

2. Automated Payroll Calculations

This feature ensures that your payroll calculations are accurate every time, minimizing the risk of errors that could lead to costly penalties.

3. Direct Deposit

The direct deposit feature eliminates the need for paper checks and reduces the risk of fraud. You can pay your employees directly into their bank accounts, saving time and money.

4. Automated Tax Calculations

With QuickBooks Enhanced Payroll 2011, you can easily calculate and pay your taxes, making the process of tax management effortless.

5. Tax Forms Filing

This feature allows you to file tax forms electronically, reducing the time and hassle of manual filing. QuickBooks Enhanced Payroll 2011 supports various tax forms such as W-2, 1099, and 940/941.

Price

The price of QuickBooks Enhanced Payroll 2011 varies depending on the number of employees that you need to manage. The base price for one employee is $19.75 per month, and you can add additional employees at an extra cost.

Customer Support

Intuit, the parent company of QuickBooks Enhanced Payroll 2011, offers excellent customer support to its clients. They have a detailed help page that provides answers to frequently asked questions, a community forum where users can connect and share ideas, and a phone support team that is available 24/7 to assist you.

User Reviews

Here are some user reviews of QuickBooks Enhanced Payroll 2011:“QuickBooks Enhanced Payroll has simplified our payroll process, making it quick and easy to pay employees and file taxes. We no longer have to keep track of paper records, and the direct deposit feature has been a game-changer.” – John D.“We have been using QuickBooks Enhanced Payroll for several years now, and it has been a lifesaver. It is easy to use, and the customer support team is always there to help us out whenever we need it.” – Lisa S.“QuickBooks Enhanced Payroll has everything we need to manage our payroll and taxes effectively. It is a must-have tool for any small or medium-sized business. Highly recommended!” – Ryan K.

Conclusion

In conclusion, QuickBooks Enhanced Payroll 2011 is an excellent payroll software that offers an array of features to help businesses manage their payroll and taxes effectively. It is easy to use, comes with time-saving features, and offers excellent customer support. We highly recommend it to any business owner looking to streamline their payroll and accounting processes.

![Amazon.com: Band-in-a-Box 2019 Pro for Mac [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2024/04/2O6e4Cw25Z6a.jpg) Band in a Box 2019 Flash Drive Review

Band in a Box 2019 Flash Drive Review  WorldViz SightLab Tracking Software Omnicept Review

WorldViz SightLab Tracking Software Omnicept Review  Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8

Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8  Review of Image Line Software Studio Signature Bundle

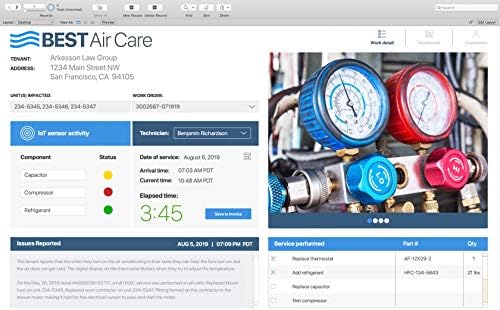

Review of Image Line Software Studio Signature Bundle  FileMaker Pro Advanced Review

FileMaker Pro Advanced Review ![Amazon.com: Punch! ViaCAD 2D/3D v12- For Mac [Mac Download] : Software](https://www.coupondealsone.com/wp-content/uploads/2024/04/YBusi9QdX6E2.jpg) ViaCAD v12 for Mac Review

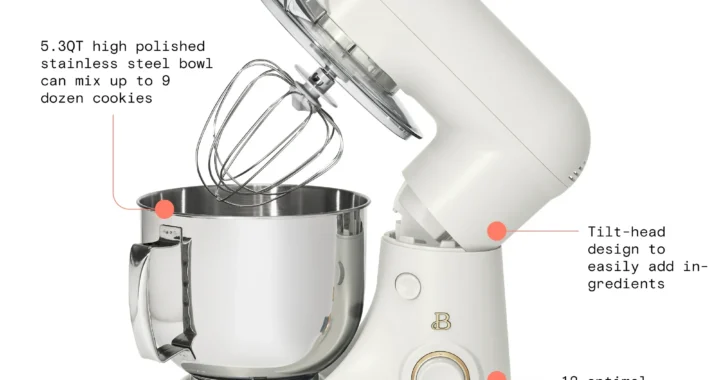

ViaCAD v12 for Mac Review  Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer

Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer  Review of the Sterilizer Charging Wireless Certified Sanitizer

Review of the Sterilizer Charging Wireless Certified Sanitizer  DESTEK VR Controller Review

DESTEK VR Controller Review