Quicken Home Business 2011: A Comprehensive Solution for Your Financial Needs

![Amazon.com: Quicken Home & Business 2011 - [Old Version] : Everything Else](https://www.coupondealsone.com/wp-content/uploads/2023/04/kc1B6Be8h3fW.jpg)

Introduction

Quicken Home Business 2011 is a popular finance management software that provides solutions for both personal and business financial management. This software has several features that can help you get a better grip on your finances and make informed decisions. The software is designed to be user-friendly and provides you with different tools and reports to help you manage your finances. This review will dive deeper into the features and functionalities of Quicken Home Business 2011 to inform you if it’s worth your money and time.

Key Features

Quicken Home Business 2011 has several features that can help you manage your financial life, including:

1. Income and Expense Tracking

With Quicken Home Business 2011, you can quickly track your income and expenses. You can also categorize your expenses to get a better idea of your spending habits. This feature can help you prioritize your expenses and make intelligent financial decisions to save money.

2. Invoice Creation

Another powerful feature of Quicken Home Business 2011 is that it allows you to create invoices for customers. You can customize the invoices to reflect your branding and include necessary information such as due date and payment terms.

3. Investment Tracking

Quicken Home Business 2011 allows you to track your investments over time. You can link your stocks, bonds, and mutual fund holdings to the software and get access to reports on your portfolio’s performance. This feature can help you make decisions on your portfolio allocation for better financial returns.

4. Tax Tracking

One of the most challenging aspects of managing your finances is tracking your tax obligations. Quicken Home Business 2011 provides you with tools that help you estimate your taxes owed and create reports to prepare for tax season. This feature ensures that you don’t miss any crucial tax deadlines.

5. Financial Planning Tools

Quicken Home Business 2011 has several financial planning tools that can help you reach your long-term financial goals. You can use the software to set up a budget, create a debt reduction plan, and save for your children’s college education.

Pros and Cons of Quicken Home Business 2011

While Quicken Home Business 2011 has several features that make it a desirable financial management tool, it also has some drawbacks:

Pros

1. User-Friendly Interface

Quicken Home Business 2011 is designed to be user-friendly. You don’t need to be an expert in finance to use the software. The software’s dashboard provides a snapshot of your financial situation, making it easy to understand your finances quickly.

2. Comprehensive financial management tools

Quicken Home Business 2011 provides several financial management tools in one place. You don’t need to switch from one software to another to manage different aspects of your finances.

3. Integration with financial institutions

Quicken Home Business 2011 can integrate with financial institutions to download your bank and credit card transactions automatically. This feature reduces errors and saves time for manual data entry.

Cons

1. Expensive

Quicken Home Business 2011 is an expensive software, and the price can continue to increase with each new update. While the software provides several features, you may find it challenging to justify the cost.

2. Inconsistent performance

Quicken Home Business 2011 may not perform consistently for all its users. Some users report experiencing multiple crashes, and it can be frustrating to lose all your data.

3. Limited customer support

Quicken Home Business 2011 has a limited customer support team. It can be challenging to get assistance when you experience challenges, and you may have to rely on forums to get help.

Conclusion

If you’re looking for one software to manage all aspects of your financial life, Quicken Home Business 2011 could be a wise investment. The software provides several features and functionalities that can help you manage your finances and make informed decisions. However, the software’s cost can be a downside, and its inconsistent performance for some users can be a turn-off. Nevertheless, if you’re willing to invest in this software, it could be your go-to solution for financial management.

![Amazon.com: Band-in-a-Box 2019 Pro for Mac [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2024/04/2O6e4Cw25Z6a.jpg) Band in a Box 2019 Flash Drive Review

Band in a Box 2019 Flash Drive Review  WorldViz SightLab Tracking Software Omnicept Review

WorldViz SightLab Tracking Software Omnicept Review  Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8

Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8  Review of Image Line Software Studio Signature Bundle

Review of Image Line Software Studio Signature Bundle  FileMaker Pro Advanced Review

FileMaker Pro Advanced Review ![Amazon.com: Punch! ViaCAD 2D/3D v12- For Mac [Mac Download] : Software](https://www.coupondealsone.com/wp-content/uploads/2024/04/YBusi9QdX6E2.jpg) ViaCAD v12 for Mac Review

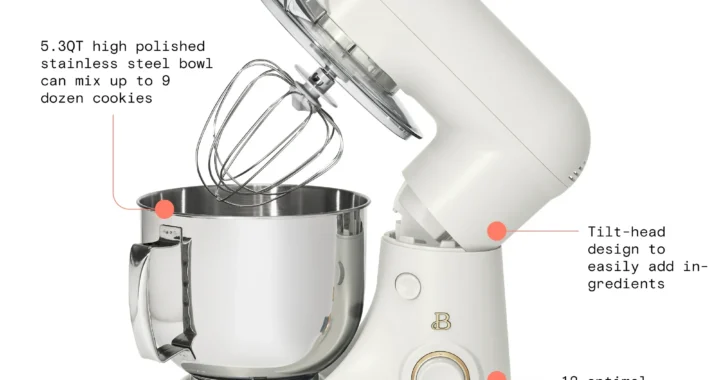

ViaCAD v12 for Mac Review  Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer

Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer  Review of the Sterilizer Charging Wireless Certified Sanitizer

Review of the Sterilizer Charging Wireless Certified Sanitizer  DESTEK VR Controller Review

DESTEK VR Controller Review  Translate English to Albanian Review

Translate English to Albanian Review