Review: Dave Ramsey’s Personal Finance Software

The Ultimate Tool for Managing Your Finances

Welcome to my comprehensive review of Dave Ramsey’s Personal Finance Software. In this article, we will delve into the features, benefits, and user experience of this acclaimed financial management tool. As an avid user of this software, I have personally experienced the positive impact it can have on one’s financial journey. So, let’s dive in and discover how this software can transform your financial situation.

Introduction to Dave Ramsey’s Personal Finance Software

Designed by one of the most renowned and respected financial experts, Dave Ramsey, this software is a comprehensive solution for managing your finances effectively. With a focus on budgeting, tracking expenses, and setting financial goals, this software provides you with the tools necessary to take charge of your financial future.

Key Features of Dave Ramsey’s Personal Finance Software

Let’s explore some of the standout features of Dave Ramsey’s Personal Finance Software:

1. Easy Budget Creation

The software offers a user-friendly interface that allows you to create and customize a budget that suits your financial goals and lifestyle. With the ability to allocate your income to various categories, you gain clarity on where your money is going and how you can optimize your spending.

2. Expense Tracking

The software enables you to effortlessly track your expenses by linking your bank accounts and credit cards. This automatic tracking feature eliminates the need for manual entry and provides you with real-time insights into your spending habits.

3. Goal Setting and Monitoring

Setting financial goals is crucial for long-term success. This software allows you to set personalized goals, such as saving for a vacation, paying off debt, or building an emergency fund. With progress tracking and visual representations, you can stay motivated on your financial journey.

4. Debt Snowball Method

Dave Ramsey’s Personal Finance Software incorporates his renowned debt snowball method, which focuses on paying off debts systematically. By prioritizing your debts and creating a step-by-step plan, you can accelerate your debt repayment and gain financial freedom sooner.

5. Investment Tracking

For those looking to track their investments and monitor their portfolio performance, this software offers features to analyze and manage your investment accounts. With real-time data and informative visuals, you can stay informed about your investment progress.

The Benefits of Using Dave Ramsey’s Personal Finance Software

Now that we’ve explored the key features of this software, let’s discuss the numerous benefits it offers:

1. Enhanced Financial Awareness

By utilizing this software, you gain a comprehensive understanding of your financial situation. Be it your income, expenses, or debts, you have all the information at your fingertips. This awareness empowers you to make informed financial decisions.

2. Improved Budgeting and Savings

The software’s budgeting tools help you allocate your income efficiently, ensuring you’re not overspending in any particular area. With clear visibility into your expenditures, you can identify areas where you can cut back and save more effectively.

3. Accelerated Debt Repayment

If you’re burdened with debt, this software can provide a roadmap to becoming debt-free. By utilizing the debt snowball method and tracking your progress, you can stay motivated and make strategic decisions to pay off your debts faster.

4. Comprehensive Financial Goal Planning

Whether you’re saving for a down payment on a house, planning for retirement, or aiming to build an emergency fund, this software helps you set and monitor your financial goals. With a clear plan in place, achieving these goals becomes more attainable.

5. Simplified Investment Tracking

For individuals with investments, this software offers a user-friendly platform to monitor their investment performance. With accurate data and insights, you can make informed decisions about your investment portfolio.

The User Experience: Ease of Use and Navigation

One of the major strengths of Dave Ramsey’s Personal Finance Software is its intuitive user interface and seamless navigation. Whether you’re a beginner or an experienced user, you’ll find the software easy to navigate, with all the necessary features accessible within a few clicks.

Customer Support and Community

Dave Ramsey’s Personal Finance Software provides excellent customer support to ensure that users have a smooth experience. From responsive email support to comprehensive user guides, the software team is dedicated to helping users maximize the benefits of the software. Additionally, the software boasts a thriving online community where users can connect, share experiences, and gain insights from fellow financial enthusiasts.

Pricing Options

Dave Ramsey’s Personal Finance Software offers three pricing plans: Basic, Plus, and Premium. The Basic plan is free to use and provides essential budgeting and expense tracking features. The Plus plan, available for a monthly subscription, offers advanced functionalities such as debt tracking and investment analysis. The Premium plan, also available for a monthly subscription, includes additional features like automatic transaction categorization and priority customer support.

Conclusion

In conclusion, Dave Ramsey’s Personal Finance Software is a comprehensive and user-friendly tool that can significantly improve your financial management skills. With its array of features, goal setting capabilities, and investment tracking tools, it provides an all-in-one solution for individuals seeking financial stability and long-term wealth creation.

Start your journey toward financial freedom with Dave Ramsey’s Personal Finance Software today!

![Amazon.com: Band-in-a-Box 2019 Pro for Mac [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2024/04/2O6e4Cw25Z6a.jpg) Band in a Box 2019 Flash Drive Review

Band in a Box 2019 Flash Drive Review  WorldViz SightLab Tracking Software Omnicept Review

WorldViz SightLab Tracking Software Omnicept Review  Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8

Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8  Review of Image Line Software Studio Signature Bundle

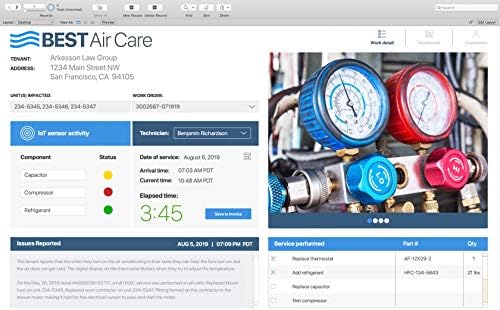

Review of Image Line Software Studio Signature Bundle  FileMaker Pro Advanced Review

FileMaker Pro Advanced Review ![Amazon.com: Punch! ViaCAD 2D/3D v12- For Mac [Mac Download] : Software](https://www.coupondealsone.com/wp-content/uploads/2024/04/YBusi9QdX6E2.jpg) ViaCAD v12 for Mac Review

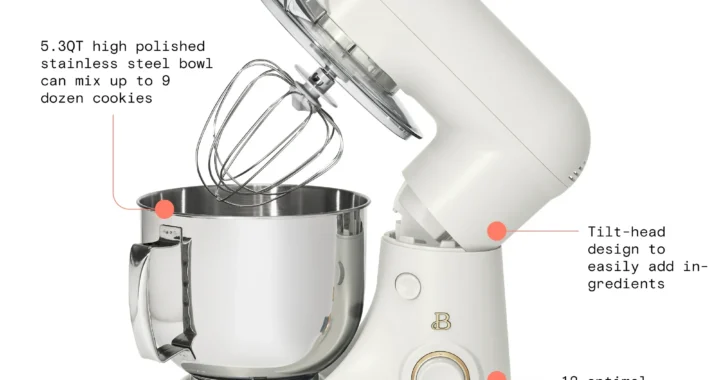

ViaCAD v12 for Mac Review  Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer

Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer  Review of the Sterilizer Charging Wireless Certified Sanitizer

Review of the Sterilizer Charging Wireless Certified Sanitizer  DESTEK VR Controller Review

DESTEK VR Controller Review