Start a Credit Monitoring Service for Your Business

As a business owner, it is important to keep an eye on your business credit score and report. A good credit score can help you secure financing, negotiate better terms with vendors and suppliers, and even attract better clients. On the other hand, a poor credit score can limit your business opportunities and affect your bottom line.To help you keep track of your business credit score and report, you may want to consider using a credit monitoring service. In this review, we will discuss the benefits of a credit monitoring service, how to choose the right provider, and some of the best credit monitoring services available for businesses.

What is a Credit Monitoring Service?

A credit monitoring service is a tool that allows businesses to keep track of their credit score and report. The service typically provides regular updates on any changes to the credit report, such as new inquiries or accounts opened in the business’s name.In addition, some credit monitoring services also offer fraud detection and identity theft protection. This means that the service can alert you if any suspicious activity is detected on your credit report, giving you the opportunity to take action before any damage is done.

The Benefits of a Credit Monitoring Service

There are several benefits to using a credit monitoring service for your business, including:

1. Early Detection of Errors

Errors on your business credit report can negatively impact your credit score and limit your business opportunities. A credit monitoring service can help you catch and correct these errors early on, before they become a bigger problem.

2. Fraud Detection

A credit monitoring service can also help protect your business from fraud and identity theft. The service can alert you if any unauthorized accounts or inquiries are made in your business’s name, allowing you to take action and protect your credit score.

3. Improved Credit Score

By regularly monitoring your business credit score and report, you can take steps to improve your credit score over time. This can lead to better financing terms, lower interest rates, and more opportunities for your business.

By regularly monitoring your business credit score and report, you can take steps to improve your credit score over time. This can lead to better financing terms, lower interest rates, and more opportunities for your business.

How to Choose the Right Credit Monitoring Service

When choosing a credit monitoring service for your business, there are several factors to consider, including:

1. Features

Different credit monitoring services offer different features, so it is important to choose one that meets your specific needs. Consider whether you need fraud detection, credit score monitoring, or identity theft protection, and look for a service that offers those features.

2. Price

The cost of a credit monitoring service can vary widely depending on the provider and the features offered. Look for a service that fits within your budget, but be sure to choose one that offers comprehensive monitoring and protection.

3. Reputation

It is important to choose a credit monitoring service with a good reputation in the industry. Look for reviews from other business owners and check the provider’s rating with the Better Business Bureau.

It is important to choose a credit monitoring service with a good reputation in the industry. Look for reviews from other business owners and check the provider’s rating with the Better Business Bureau.

The Best Credit Monitoring Services for Businesses

Now that you know what to look for in a credit monitoring service, here are some of the best options for businesses:

Now that you know what to look for in a credit monitoring service, here are some of the best options for businesses:

1. Experian

Experian is one of the three major credit bureaus and offers a comprehensive credit monitoring service for businesses. The service provides real-time alerts for any changes to your credit report, as well as identity theft protection and access to your business credit score.

2. Equifax

Equifax is another major credit bureau that offers a credit monitoring service for businesses. The service includes credit score monitoring, alerts for any changes to your credit report, and identity theft protection.

3. Dun & Bradstreet

Dun & Bradstreet is a business credit reporting agency that offers a credit monitoring service for businesses. The service includes alerts for changes to your credit report, access to your Dun & Bradstreet credit score, and fraud detection.

4. CreditSignal

CreditSignal is a free credit monitoring service offered by Dun & Bradstreet. The service provides alerts for any changes to your business credit report, as well as access to your Dun & Bradstreet credit score.

Conclusion

If you want to keep track of your business credit score and report, a credit monitoring service can be a valuable tool. By choosing the right provider and regularly monitoring your credit, you can protect your business from fraud, improve your credit score, and unlock new business opportunities.

If you want to keep track of your business credit score and report, a credit monitoring service can be a valuable tool. By choosing the right provider and regularly monitoring your credit, you can protect your business from fraud, improve your credit score, and unlock new business opportunities.

![Amazon.com: Band-in-a-Box 2019 Pro for Mac [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2024/04/2O6e4Cw25Z6a.jpg) Band in a Box 2019 Flash Drive Review

Band in a Box 2019 Flash Drive Review  WorldViz SightLab Tracking Software Omnicept Review

WorldViz SightLab Tracking Software Omnicept Review  Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8

Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8  Review of Image Line Software Studio Signature Bundle

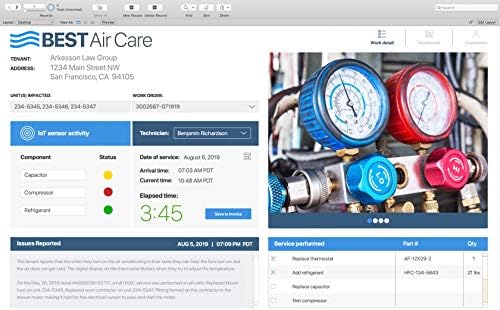

Review of Image Line Software Studio Signature Bundle  FileMaker Pro Advanced Review

FileMaker Pro Advanced Review ![Amazon.com: Punch! ViaCAD 2D/3D v12- For Mac [Mac Download] : Software](https://www.coupondealsone.com/wp-content/uploads/2024/04/YBusi9QdX6E2.jpg) ViaCAD v12 for Mac Review

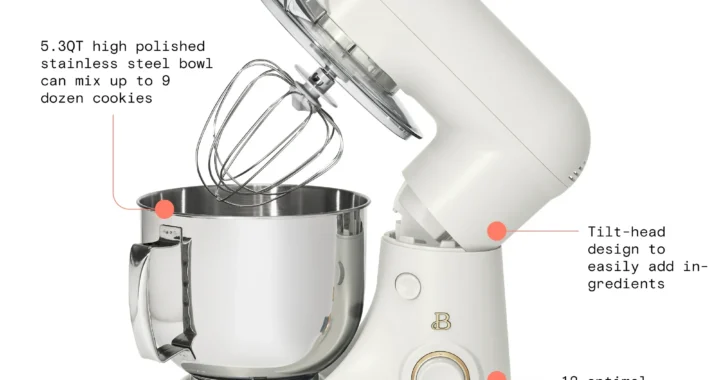

ViaCAD v12 for Mac Review  Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer

Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer  Review of the Sterilizer Charging Wireless Certified Sanitizer

Review of the Sterilizer Charging Wireless Certified Sanitizer  DESTEK VR Controller Review

DESTEK VR Controller Review