Start Up Your Own Personal Loan Company and Be Your Own Boss

Are you considering starting your own personal loan company? This may be a great move for you if you have always dreamed of running your own business. However, starting a loan company can be a daunting task. This comprehensive guide is packed with valuable information to help you get started.

Why Start a Personal Loan Company?

Starting a personal loan company can be a fantastic option for entrepreneurs with goal-oriented mindsets. Personal loan companies offer a valuable service to people in need of quick cash for various reasons, whether it be an unexpected expense or to pay off existing debts. You will be providing a useful service while also running your own business – it’s a win-win situation.

Research Your Market

Like any other business, market research is crucial for starting your own personal loan company. Look into your local area, and see what other lenders are offering. You want to ensure that you are providing a unique and valuable service to your potential customers. You also want to make sure that there isn’t an oversaturation of lenders in your area.

Legal Requirements

Before you can start your own personal loan company, you need to make sure you comply with all legal and regulatory requirements in your area. This will vary by location, so do your research beforehand. You may need to obtain specific licenses or permits, and ensure that every aspect of your business is in line with local and federal laws.

Choose Your Business Structure

When starting any business, you need to carefully consider which business structure you will use. Will you be a sole proprietor, a partnership, or a corporation? Each structure comes with its own benefits and drawbacks, so it’s important to choose the one that is the best for you and your business goals.

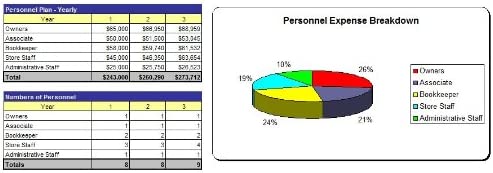

Creating a Business Plan

Like any other business, it’s essential to create a business plan for your personal loan company. This will guide you through the process and give you a clear outline of what you need to achieve. Your business plan should be detailed and include projections for revenue, expenses, and a marketing plan.

Marketing Your Business

Marketing your personal loan company is critical to your success. You need to reach your target audience and let them know what services you offer. Your marketing efforts should include a variety of strategies, such as social media marketing, search engine optimization, and direct mail marketing.

Building a Team

One of the most crucial things for success in any business is having a great team. Hiring the right people will help ensure that your business is successful in the long-term. You want to find people who are passionate about your business and your mission, and who are dedicated to ensuring your customers are satisfied.

One of the most crucial things for success in any business is having a great team. Hiring the right people will help ensure that your business is successful in the long-term. You want to find people who are passionate about your business and your mission, and who are dedicated to ensuring your customers are satisfied.

Choosing a Location

Your location will play a significant role in the success of your personal loan company. You want to make sure that your location is in a high-traffic area where people will see your business frequently. You also need to ensure that your location is safe and welcoming to customers.

Your location will play a significant role in the success of your personal loan company. You want to make sure that your location is in a high-traffic area where people will see your business frequently. You also need to ensure that your location is safe and welcoming to customers.

Financing Your Business

Starting any business requires financing, and a personal loan company is no different. You can finance your business through a variety of sources, such as loans, investors, or your own savings. You need to carefully consider your financing options and choose the ones that are right for you and your business.

Starting any business requires financing, and a personal loan company is no different. You can finance your business through a variety of sources, such as loans, investors, or your own savings. You need to carefully consider your financing options and choose the ones that are right for you and your business.

Building a Strong Online Presence

In today’s digital world, having a strong online presence is essential for any business. Utilizing social media, building a website, and creating a blog are critical for building your brand and reaching your target audience. You want to make sure that your online presence is professional and effective.

Managing Cash Flow

Managing cash flow is an essential part of any business, and a personal loan company is no exception. You need to ensure that you have enough cash to cover your expenses and make sure that your customers’ payments are made on time. You also want to make sure that you allow for late payments or non-payments.

Providing Excellent Customer Service

Providing excellent customer service is critical for any business, and it’s especially important for personal loan companies. Borrowing money can be a sensitive topic for many people, so you want to make sure your customers feel comfortable and supported throughout the process.

Understanding Regulations

As a personal loan company, you will be subject to various regulations and laws. It’s important to keep up-to-date with these regulations and ensure that your business is compliant. This includes staying abreast of any changes in the law and adjusting your processes accordingly.

As a personal loan company, you will be subject to various regulations and laws. It’s important to keep up-to-date with these regulations and ensure that your business is compliant. This includes staying abreast of any changes in the law and adjusting your processes accordingly.

Creating a Loan Process

Creating a loan process is critical to the success of your personal loan company. Your process should be clear, easy to follow, and help your customers feel confident and comfortable. You want to ensure that your process is streamlined and effective, so that customers can receive their funds quickly.

Providing Competitive Rates

Providing competitive rates for your customers is essential to remain competitive in the personal loan market. You want to ensure that your rates are reasonable and fair, while still allowing you to make a profit. You need to keep track of industry rates and adjust yours accordingly.

Building Trust

Building trust with your customers is vital for your personal loan company’s success. You want your customers to feel confident in your company and to trust that you will provide them with the best service possible. This can be achieved through excellent customer service, transparent policies, and clear communication.

Finding Investors

Finding investors for your personal loan company can help you grow your business quickly. Investors can provide you with the capital you need to expand your operations and reach more customers. You want to find investors who are aligned with your goals and are willing to support your vision.

Creating a Unique Brand

Creating a unique brand is essential for any business, including a personal loan company. You want to create a brand that is recognizable, trustworthy, and memorable. This can be achieved through effective marketing, excellent customer service, and consistent branding.

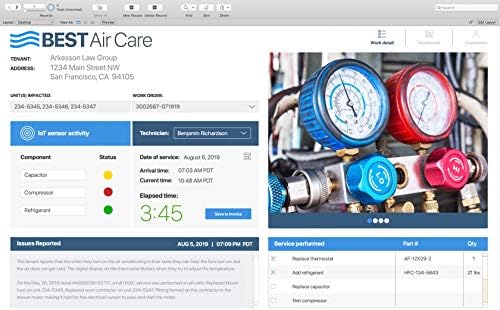

Choosing a Software Solution

Choosing the right software solution is essential for personal loan companies. You need software that is reliable, secure, and will help streamline your processes. You also want software that is user-friendly and easy to navigate, so that your employees can focus on providing excellent customer service.

Creating Policies and Guidelines

Creating policies and guidelines for your personal loan company will help ensure that your employees are consistent in their approach to serving customers. Your policies should be clear and easy to follow, and should cover all aspects of the loan process.

Implementing Security Measures

Implementing security measures is critical for any business, but especially so for a personal loan company. You want to ensure that your customers’ personal and financial information is kept safe and secure. This includes keeping your software up-to-date, installing firewalls and antivirus software, and conducting regular security audits.

Staying Competitive

Staying competitive in the personal loan market is essential for your company’s success. You need to keep up-to-date with industry trends, regulations, and customer needs. You also want to ensure that you are offering the best service possible, and that you have a smart marketing and advertising strategy in place.

Conclusion

Starting your own personal loan company can be a challenging but rewarding experience. By following the steps outlined in this guide, you can create a successful loan company that serves the needs of your community. With the right tools, resources, and dedication, you can become your boss and build a business that you’re proud of.

![Amazon.com: Band-in-a-Box 2019 Pro for Mac [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2024/04/2O6e4Cw25Z6a.jpg) Band in a Box 2019 Flash Drive Review

Band in a Box 2019 Flash Drive Review  WorldViz SightLab Tracking Software Omnicept Review

WorldViz SightLab Tracking Software Omnicept Review  Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8

Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8  Review of Image Line Software Studio Signature Bundle

Review of Image Line Software Studio Signature Bundle  FileMaker Pro Advanced Review

FileMaker Pro Advanced Review ![Amazon.com: Punch! ViaCAD 2D/3D v12- For Mac [Mac Download] : Software](https://www.coupondealsone.com/wp-content/uploads/2024/04/YBusi9QdX6E2.jpg) ViaCAD v12 for Mac Review

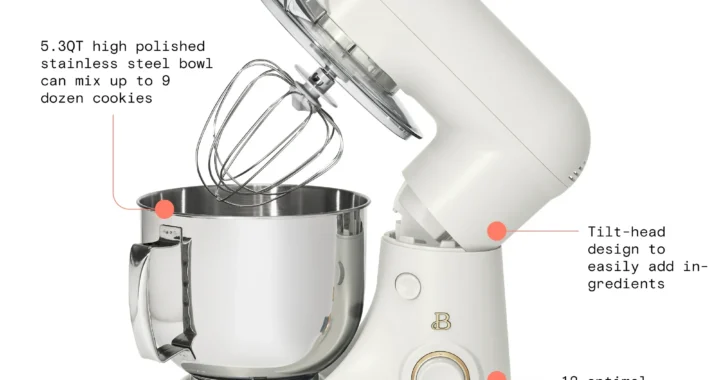

ViaCAD v12 for Mac Review  Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer

Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer  Review of the Sterilizer Charging Wireless Certified Sanitizer

Review of the Sterilizer Charging Wireless Certified Sanitizer  DESTEK VR Controller Review

DESTEK VR Controller Review