TurboTax Business Federal + File State Review: A Comprehensive Tax Solution for Small Business Owners

![Amazon.com: TurboTax Home & Business Federal + e-File + State 2010 - [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2023/04/vCCyNJzp2vvp.jpg)

Introduction

If you’re a small business owner, you know how stressful tax season can be. You have to keep track of all your expenses, revenue, payroll, and more. With all the paperwork and forms, it can be overwhelming. Luckily, TurboTax Business Federal + File State is here to help. This tax software is specifically designed for small business owners and makes tax filing easy and stress-free.

Features

TurboTax Business Federal + File State has all the features you need to have a smooth tax filing experience. It allows you to file your taxes electronically, which saves time and money. The software generates both federal and state tax forms, and even includes step-by-step guidance and support. The software also includes a deduction finder, which helps you find every possible deduction to maximize your tax return.

Ease of Use

One of the best things about TurboTax Business Federal + File State is how easy it is to use. The software is intuitive and user-friendly. The guided workflow ensures that you don’t miss anything important, and the software saves your progress along the way. You can also import data from spreadsheets or other accounting software, which saves even more time.

Support

TurboTax Business Federal + File State provides excellent support options. You can get help via phone, chat, or email, and there’s even a community forum where you can ask questions and discuss tax-related topics with other users. The support team is knowledgeable, friendly, and always willing to help.

Security

When it comes to taxes, security is of the utmost importance. TurboTax Business Federal + File State takes security seriously and has several measures in place to keep your information safe. The software uses encryption to protect your data, and it also has two-factor authentication to prevent unauthorized access.

Benefits

Using TurboTax Business Federal + File State has several benefits. For one, it saves you time and reduces stress during tax season. It also helps you maximize your tax return by ensuring that you take advantage of every possible deduction. Additionally, the software is affordable and can save you money compared to hiring a professional tax preparer.

Drawbacks

While TurboTax Business Federal + File State is an excellent tax software, it does have a few drawbacks. For one, it’s not as customizable as some other tax software options. Additionally, it may not be suitable for very large or complex businesses that require a more robust tax solution.

Price

TurboTax Business Federal + File State is priced competitively and is affordable for most small business owners. The software is currently available for purchase on Amazon for $139.99. While it’s not the cheapest tax software available, it’s well worth the investment for the peace of mind it provides during tax season.

Alternatives

If TurboTax Business Federal + File State doesn’t meet your needs, there are several alternatives you can consider. One popular option is H&R Block Business. This software offers similar features, but may be more customizable for larger businesses. Another alternative is TaxAct, which is a more affordable option for smaller businesses.

Conclusion

Overall, TurboTax Business Federal + File State is an excellent tax software solution for small business owners. It’s intuitive, easy to use, and provides all the features you need to file your taxes accurately and efficiently. With excellent support options and robust security measures, TurboTax is definitely worth considering this tax season.

![Amazon.com: Band-in-a-Box 2019 Pro for Mac [Old Version]](https://www.coupondealsone.com/wp-content/uploads/2024/04/2O6e4Cw25Z6a.jpg) Band in a Box 2019 Flash Drive Review

Band in a Box 2019 Flash Drive Review  WorldViz SightLab Tracking Software Omnicept Review

WorldViz SightLab Tracking Software Omnicept Review  Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8

Math ACE Jr. Review: A Must-Have Learning Tool for Kids Ages 4-8  Review of Image Line Software Studio Signature Bundle

Review of Image Line Software Studio Signature Bundle  FileMaker Pro Advanced Review

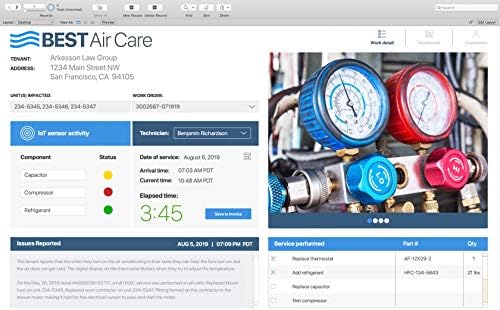

FileMaker Pro Advanced Review ![Amazon.com: Punch! ViaCAD 2D/3D v12- For Mac [Mac Download] : Software](https://www.coupondealsone.com/wp-content/uploads/2024/04/YBusi9QdX6E2.jpg) ViaCAD v12 for Mac Review

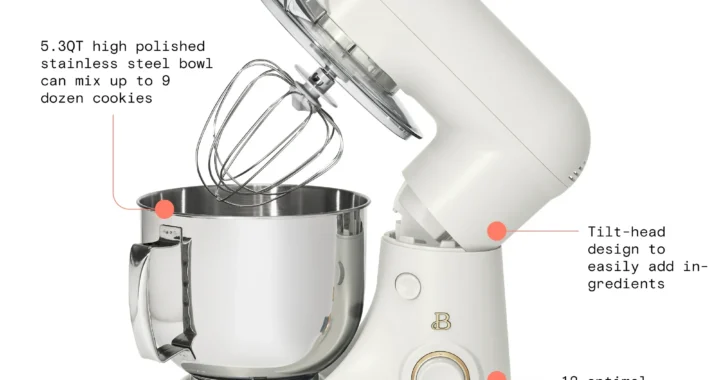

ViaCAD v12 for Mac Review  Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer

Elevate Your Baking with the Stylish and Powerful Drew Barrymore 5.3-Quart Stand Mixer  Review of the Sterilizer Charging Wireless Certified Sanitizer

Review of the Sterilizer Charging Wireless Certified Sanitizer  DESTEK VR Controller Review

DESTEK VR Controller Review  Translate English to Albanian Review

Translate English to Albanian Review